#1 Tax Year 2025: Prepare for Tax Reporting Season

Follow these steps to prepare for the tax year 2025 season if your organization utilizes Superior's Black solution.

Separate training modules will be created to address the different stages of tax reporting season.

In this training module, we will help your organization prepare for the upcoming tax reporting season and discuss the tasks that were added to your Dashboard at the end of 2025 (briefly outlined below this video).

Click HERE to view the training module.

You can also access a printable handout for taking notes HERE.

Brief Outline of Tasks Discussed in Training Module

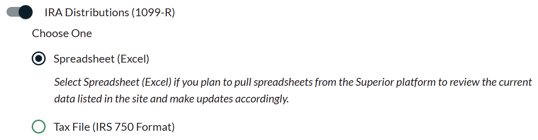

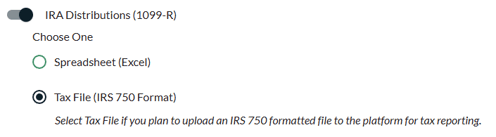

- Confirm Your Tax Reporting Settings for Tax Year 2025: Verify your organization's reporting method preferences.

- Spreadsheet: Your organization will download distribution and/or FMV/deposit spreadsheets from the Superior platform to review the current data listed in the platform and make updates accordingly to those records.

- Tax File (IRS 750 Format): Your organization will upload an IRS 750 formatted file to the Superior platform for the 1099 and/or 5498 series reporting and review/correct any mismatching values that may occur from that file upload.

The guidelines for each record and file type for tax year 2025 are outlined here: TY 2025 Record Layout for IRS Files. They're also reflected in IRS Publication 1220.

- Spreadsheet: Your organization will download distribution and/or FMV/deposit spreadsheets from the Superior platform to review the current data listed in the platform and make updates accordingly to those records.

- Confirm Accuracy of Account Owner Data: Pull an account owner list from the Superior platform and confirm account owner data (i.e., names, addresses, tax IDs) is correct. Update any inaccurate information in the platform accordingly.

REVIEW NEXT TAX REPORTING STEPS:

#2: Submit 1099 Data to Superior

#3: Submit 5498 Data to Superior

#5: Approve Tax Form Production

#6: Submit Tax Form Corrections (If Applicable)

#7: Download Electronic Tax Forms (If Applicable)

#8: Retrieve 1099 State Tax Files (For State Reconciliation If Applicable)